10 Tips on How to Save That Money and Finally go Overseas

Table of Contents

If you’re dying to go overseas long term, but are short on cash, you’re going to have to come up with some creative ways to save that money before you go. I know it sounds easier said than done.

Trust me though, if the two of us, a bartender and cook, can save 16k in 10 months you can too. All it takes is a few, fairly drastic, lifestyle changes. If the changes seem too drastic just ask yourself, “do I really want to be living here after another year?“.

If the answer is “no“, and you’re really serious about living overseas, some sacrifices will need to be made. They’ll all be worth it once you’re laying on the beach without a care in the world.

Evaluate Where you are and Where you Want to Be

This trip isn’t our first extended trip overseas. In 2011 we lived in Jamaica for about six months. After returning home we decided to make long term travel a big part of our lives.

“Why“, we asked ourselves, would we want to emulate the typical American lifestyle of working ourselves to death for 45 years, and then spend our old age traveling; assuming we’d even be healthy enough to do so? We wanted to get out and see the world while we were young(ish) enough to enjoy it.

For the first year after our return from Jamaica, we led a pretty normal American life; working more hours than we spent together, eating out nearly every night, drinking in bars, and buying a lot of useless stuff we, eventually, realized we just didn’t need.

In the Spring of 2013, we assessed our situation and realized that the lifestyle we were leading wasn’t getting us any closer to our dream of long term travel. We decided then and there; changes need to be made. Instead of spending so much, we needed to save that money for our travel goals.

Give Yourself an Incentive to Save for Your Trip

Without an incentive, chances are you’ll always find excuses to delay going overseas. We certainly did. Prior to us taking our trip seriously we talked endlessly about moving back overseas. Since we had no incentive, we did very little about it.

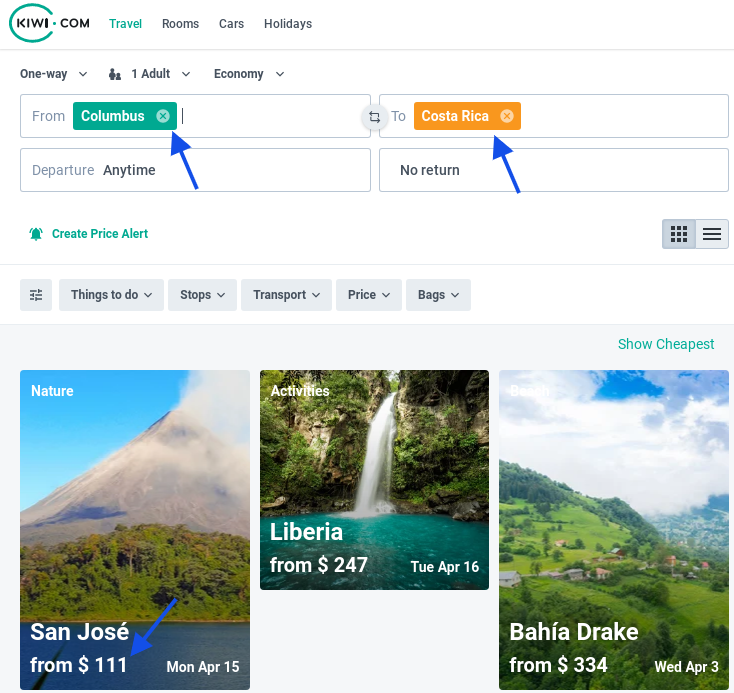

That quickly changed. Fed up once again with life in the States we finally began to take our overseas trip seriously. We picked a random date, about 10 months into the future, and bought the cheapest one-way ticket out of the country we could find; NYC to Costa Rica for less than $150 one-way.

The destination didn’t really matter to us. We knew we wanted to be somewhere tropical and warm, and near a beach. Costa Rica fit that criteria and the tickets there were super-cheap. Not only did we now have tickets out of the country, but we also had the incentive we needed to start saving.

Ten Things you can do to Save that Money for Your Overseas Trip

Once the tickets to Costa Rica were bought, life started to change pretty quickly. Money started to get saved instead of spent. Some of the below tips will be a little harder to pull off than others. I promise you though, it will be worth it once you board that plane for your destination.

Choose to incorporate all ten of the below tips, or pick and choose. Just remember; every dollar you save in the States will give you $3-$4 in a country with a lower cost of living (which is nearly every country south of our border).

#1 Start Selling Everything Off

The number of useless things we had accumulated in the year since we returned from Jamaica was mind-blowing; knickknacks, specialty kitchen tools, 100’s of books, and more clothes and shoes than we could ever wear.

The first thing we did was take inventory of everything we owned. Anything that wasn’t used, or looked at, in the past month was immediately posted on craigslist. In the following ten months, we eventually sold most everything we owned for hundreds of dollars.

#2 Forget the Expensive Phones and Overpriced Phone Plans

We were constantly made fun of by our friends because of our cheap cell phones. We previously learned, the hard way, that travel long term, and being tied to a phone plan, just doesn’t work out very well.

While our friends were spending hundreds of dollars on the newest iphone, and $100s a year on their plans, we were carrying around burners bought at Target for less than $20. Our minutes cost us less than $10 month.

Ditching your pricey phone, and cell plan, will add up to $1000 to your travel budget in just one year.

#3 Ditch Your TV

In all of our years together, we have never owned a TV. Mostly because it’s a complete waste of time and money. We have friends that are constantly complaining about being broke, but when you show up at their house you find a flat screen TV in every room, with a $100+ cable bill attached to it.

Sell the TV’s, and cancel the cable bill as soon as you can. There are a dozen better things you can be doing with your time (like learning a new language for your trip). Getting rid of your TV’s, and cable will put over $1000 in your travel coffers in about a year.

#4 Save Your Change

I know this sounds silly, but this tip put around $350 in our travel account. At the end of every day, we would put whatever change we were carrying in a large plastic jar that we glued the lid onto (after cutting a small slit in it obviously).

Our rule was we never, ever, spent change. If our total bill was $9.03, we paid with a $10 note and the change went in the jar. Every time. Ten months later, the day before we left town, we turned in our change for $350 in cash. $350 can go a hell of a long way in Central America (a month’s rent near the beach with change back).

#5 Consider Moving out of the Suburbs

We’re not much for living in the ‘burbs; too expensive, too isolated, and too dependent on a car. Getting an apartment in the city is far less expensive, and far more rewarding.

Rent in our little inner city neighborhood was half of what it would have been in the ‘burbs. Not to mention that within walking distance there were; public libraries, art galleries, bars, restaurants and coffee shops.

The amount of money we saved by living in the city was substantial. We were closer to work, there was ample public transportation, and nearly everything was within walking\biking distance.

#6 Ditch the Car

Now that you’re living in the city why not consider ditching that money pit you’re driving around. We went two years living in the city and almost never needed a car, and we certainly never missed having one.

Everything; our jobs, friends, parks, stores, and attractions were all within walking or biking distance. If for some reason, we needed to get across town we either took a bus, got an Uber or a called taxi. All of which are cheaper than owning a car.

I’ve heard people say before that owning a car is having freedom. That couldn’t be farther from the truth. Owning a car is what keeps most people from having freedom, financial or otherwise.

When I think about the expense, and stress, involved in owning a car I just don’t understand why more people don’t opt out of car ownership. Thousands of dollars a year are spent on;

- car payments

- insurance payments

- gasoline

- plates and tags

- car repairs

- buying new tires

- oil changes

- etc

Get rid of that stress, and financial hardship. Neither we nor most of our friends, owned cars and we couldn’t have been happier about it. Try this tip out and you may be able to start traveling within a few months.

#7 Get Some Roommates

Before we bought our plane tickets we had two rooms in our apartment that got almost no use. We sold everything in the rooms, and then put an add on craigslist seeking roommates for the next ten months. Two weeks later we had both rooms rented to students studying at the nearby art school.

These roommates paid 2\3 of all the utilities, and 120% of our monthly rent. The amount of money we saved, and made, by having roommates paid for six months of our living expenses while in Central America.

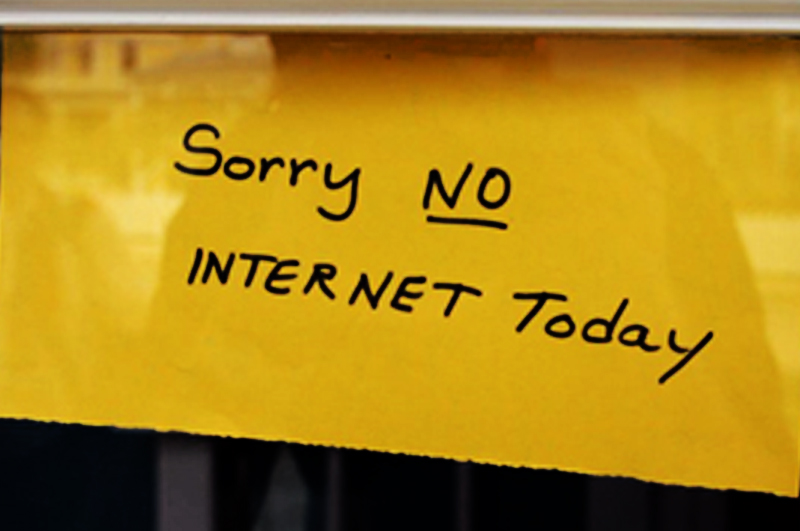

#8 Cancel Your Home Internet

Unless you work from home for 8-10 hours a day, you just don’t need internet at the house or the bill that goes with it. We went almost 2 years without internet access at our house and never once missed it. Every bar, restaurant, and coffee shop in our neighborhood had free WiFi.

If we needed to get online for anything we either used our phone’s data or simply walked a few blocks and got online while we sipped a coffee or beer. Trust me, you don’t need high-speed internet to be checking Facebook every five minutes to see what your “friends” are having for dinner that night.

Disconnecting yourself for a few hours a day is a great way to save around $500 a year, and free up some time for more important things (reading, studying a new language, or just hanging out with real friends).

#9 Buy Second Hand

If long term travel is in your future plans you should be paring your possessions down, not buying more things. If you do need to buy something though, consider buying it second hand from craigslist or the thrift store. You’ll get the exact same product as you will in a traditional store, but you’ll be paying 50-70% less for it.

#10 Cook and Drink More at Home

Working in the service industry, as we did, has its perks. The hours may be long, but meals and drinks are heavily discounted. Even with our discounts, it was still cheaper for us to eat and drink at home. For the cost of one dinner out, we could make enough pasta sauce, curry, or casserole to last the entire week.

Do you enjoy a tasty adult beverage with your meal? I know we do! Just remember, unless you’re drinking during happy hour, that glass of wine you’re enjoying at the restaurant has been marked up, at least, 400%. Best to just enjoy your libations at home and spend that money sipping margaritas on a secluded beach somewhere on your travels.

The Sacrifices we Made to Save that Money was Well Worth It

That 16k we saved in those ten months put us on the beach for almost 2 years. That’s the power of saving US dollars and living where the cost of living is lower. We literally did nothing but chill and hang out together for 2 years.

I know the above tips sound drastic. I can assure you though, not only was making the above changes pretty easy but removing all of the above clutter and stress from our lives was very liberating.

Not only were we saving money for our dream goal, but we also didn’t have the added stress of; phone bills, cable bills, car repair headaches, credit card debt, or mortgage\rent payments.

Making the above sacrifices allowed us to spend nearly two years doing nothing but traveling, hanging on the beach, reading, writing, and just enjoying ourselves.

That was over 4 years ago. We’re still traveling full time and hanging out at the beach. The money we saved up is now long gone but we’ve figured out the tips and tricks of living overseas.

Who knows how long we’ll be able to keep all of this up. I can assure you though if our money runs out, and we are forced to return to the rat race, it’ll only be another year before we’re able to save that money again.

Paul is a full-time SEO content writer and owner of Word Brokers, LLC. He is also a full-time digital nomad who can be found writing content with his toes in the sand on a beach in Mexico, sipping an espresso in a cafe in Colombia, or chilling by the lake in Guatemala.

2 Replies to “10 Tips on How to Save That Money and Finally go Overseas”