Best Insurance For Working Abroad – SafetyWing Insurance Review

Table of Contents

(Keep in mind: Nomadic-AF is reader-supported. When you buy through links on our site, we may earn an affiliate commission (with no additional cost to you)).

No matter what your reasons are, one thing is for sure: living and working abroad can be an incredibly rewarding experience. But it can also be risky. That’s why it’s important to always have the best insurance for working abroad in place before you go.

This is why today we’re going to take a look at one of the most popular options out there: SafetyWing Insurance.

In this comprehensive SafetyWing Insurance review, we’ll talk about why we think it’s one of the best options for nomads working overseas. We’ll also go over everything you need to know about them, including their:

- installation plans

- coverage

- pricing, and

- claiming process.

Are you just looking for a quote from SafetyWing? Skip right ahead to that section by clicking here.

Want to learn everything you can about whether SafetyWing is the best insurance for working abroad? Let’s get right into it!

What Is SafetyWing Insurance?

SafetyWing Insurance is a California-based travel insurance company that provides medical coverage for both digital nomads who are working abroad and other frequent travelers.

But, what makes SafetyWing’s policies one of the best insurances for working abroad?

First of all, their plans are specifically designed by working nomads and specifically created for people who are working overseas. This means that they understand the needs of working nomads and have tailored their policies to meet those needs.

Another thing that sets them apart from other insurers is that they provide a monthly subscription-based service, so you can be covered for as long as you need it, rather than buying a one-off policy that may not cover you for the duration of your stay.

What’s more, SafetyWing Insurance is also a lot cheaper than traditional health insurance plans and offers a very comprehensive level of coverage, including:

- medical expenses

- evacuation and repatriation

- trip interruption

- lost or stolen baggage, and

- Covid-19 coverage.

Their policies also cover you for some adventurous activities, like scuba diving, horse riding, motorbiking, skiing, and canyoning, which is great news if you’re the kind of person who likes to add a bit of excitement to their work life!

SafetyWing Insurance Review: Plans & Pricing

SafetyWing Insurance offers two main types of plans:

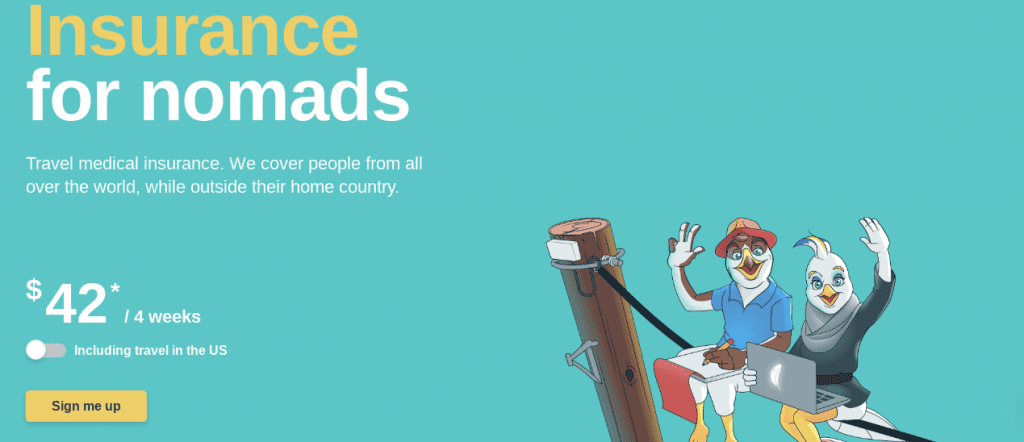

The Nomad Plan

The Nomad Insurance plan is their more popular, flexible, and comprehensive option, which covers you for everything from basic medical expenses to trip delays and interruptions.

Prices start at $42 USD/month for people aged between 10-39 years old and go up to $144 USD/month for those who are 65 and above.

But the best part?

Unlike other travel insurance, you can purchase it even if you’ve already started your trip!

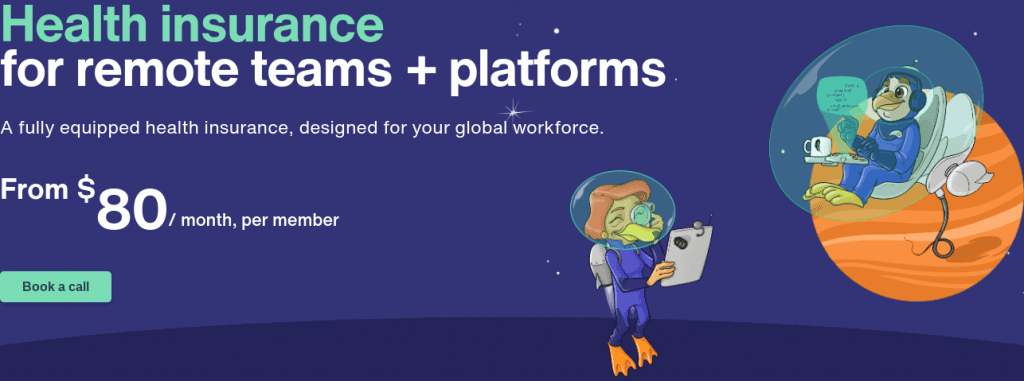

The Remote Health Plan

As the name implies, SafetyWing’s Remote Health Insurance package is mainly for medical insurance.

It’s a good option for:

- Businesses that are trying to insure a team of remote workers scattered around the globe.

- Individuals who already have comprehensive travel insurance in place but want to add an extra layer of protection for their next long-term trip overseas.

It works in every country in the world, including the U.S, UK, and Australia, and covers:

- illnesses

- accidental injuries

- cancer treatments

- palliative care

- prescription medications, and

- specialized treatments.

Plus, you can also opt to add on extras like dental coverage, screenings and vaccinations, and maternity cover, which is great news if you’re pregnant and working abroad.

Prices for the Remote Plan start at $80 USD/month.

What Is And What Isn’t Covered?

SafetyWing’s all-inclusive and best insurance for working abroad “Nomad” package is just $42 USD/month. That equates to less than $1.50 USD/day!

Yet despite the cheap price, the plan still covers you for all the main risks associated with working abroad, including:

- $250,000 USD in medical coverage

- $100,000 USD for medical evacuation

- $20,000 USD for repatriation

- $12,500-25,000 USD for dismemberment and accidental death

- $10,000 USD for evacuations due to political turmoil

- $6,000 USD for lost luggage

- $5,000 USD for trip interruptions

- $1,000 USD for dental care

- $200 for travel delays

However, just like other standard travel insurance policies, there are a few exclusions. So it’s always worth reading the terms of coverage carefully before purchasing any policy, just to make sure you understand exactly what is and isn’t covered.

For example, SafetyWing’s Nomad Insurance won’t cover you for any drug or alcohol-related incidents, or certain high-risk adventure sports like whitewater rafting, parasailing, boxing, parachuting, and bungee jumping.

It also doesn’t really cover lost or stolen cash or pricy electronics, which is a concern if you usually travel with an expensive camera or other video equipment

Does SafetyWing Offer COVID-19 Coverage?

Yes, SafetyWing Insurance has updated its policies to include coverage for COVID-19 (as long as the virus wasn’t contracted before the start of the plan). Pretty impressive, given that the global pandemic still isn’t over.

Their policies now also offer coverage for quarantine costs (outside your country of residence) of up to $50 USD a day for 10 days.

And since most insurance policies still don’t cover COVID, this can be a huge benefit — especially as countries start opening up their borders and new variants continue to develop and spread.

What About Deductibles?

We’ll be honest — we’re not huge fans of the fact that SafetyWing (like many other insurance alternatives) does feature a $250 USD deductible for most expenses.

This means that if you do have to make a claim, you’ll need to pay the first $250 of any expenses yourself out of pocket before you’re reimbursed.

For example, if you ever get sick during your trip and the hospital stay costs $1,250. You’ll have to pay $250 and your insurance will cover the rest ($1,000).

Fortunately, though, SafetyWing’s deductible is per policy period and not per claim like a lot of other insurance providers.

Meaning, that if you keep extending your subscription every month, you can be covered for an entire year and only have to pay your deductible only once.

So, if you’ve had to visit the hospital multiple times, you won’t have to pay the $250 deductible each time before your coverage kicks in.

It’s also worth bearing in mind that many other policies usually have much higher deductibles.

Plus, if your bill is in the thousands, then just having to pay $250 really isn’t that bad in the grand scheme of things (especially since you’re only paying $42/month for the policy itself).

And, we also understand that insurance deductibles are pretty standard practice in the industry, and it does help to keep premiums down.

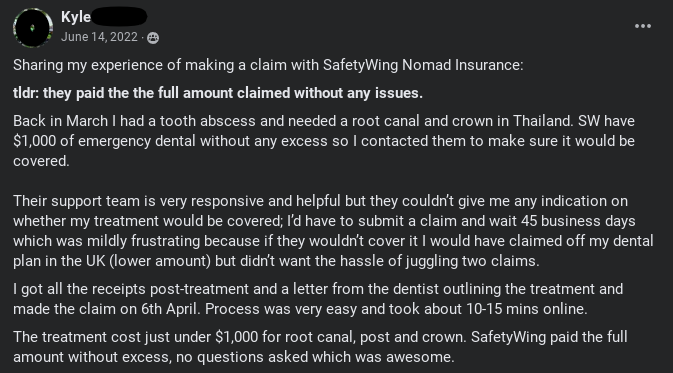

How To Make A Claim With SafetyWing

If you need to make a claim with SafetyWing, the process is pretty straightforward. All you need to do is head to their website and fill out a claim form through their online portal.

You’ll also need to upload any relevant documentation, like medical bills or police reports, and once your claim has been reviewed and approved, you should receive your payout within 30-45 business days.

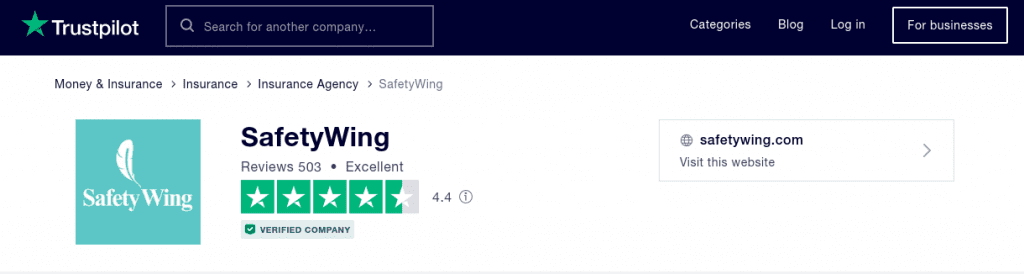

It’s also worth noting that SafetyWing has a pretty good reputation when it comes to paying out claims. In fact, they have a solid “4.4” rating on TrustPilot, with many users praising the company for their quick and efficient customer support throughout the claiming process.

On the other hand, most of the negative SafetyWing Insurance reviews on TrustPilot seem to be more related to things like billing issues or problems with customer service (because they either didn’t have knowledge about the deductible or didn’t like the time it took to get paid), rather than actual claims being denied.

Based on that, we feel confident in saying that SafetyWing is a pretty reliable and trustworthy insurance company and one that you can definitely rely on if you need to make a claim while working abroad.

Get A Quote From SafetyWing Insurance

Curious to know how much SafetyWing insurance will be for you?

If you’re interested in getting a quote from SafetyWing Insurance, fill in your details using the widget below.

Best Insurance For Working Abroad – The Pros & Cons

So, now that we’ve covered all the basics in our SafetyWing Insurance review, let’s take a more in-depth look at some of the pros and cons of SafetyWing Insurance.

| Pros | Cons |

| Starting at only $42/month SafetyWing is one of the most affordable travel insurances out there | A $250 deductible (per policy period) |

| Convenient monthly subscription-based payment model | Limited coverage for expensive electronics and equipment |

| No limits on the duration of travel | Lacks coverage for certain adventure activities |

| You can buy insurance plans online even if you’re already traveling | The older you are, the more expensive it gets |

| Provides broad coverage for COVID | Only covers till the age of 69 |

| 24/7 customer support and assistance | No coverage for trip cancellation |

| Easy to make claims online | |

| After traveling for 90 days, you get to keep your medical coverage for 30 days in your country of residence (15 days for people from the U.S) | |

| Up to 2 children per family (under the age of 10) can be included at no additional cost | |

| No hassle of having to renew your policy (renews your subscription every 4 weeks automatically) |

Who Is SafetyWing Good For?

SafetyWing insurance is a great choice for digital nomads, freelancers, and anyone else who works online and travels frequently.

It’s also perfect for those who are looking for medical and travel coverage at an affordable price.

This is why we switched over from our previous insurance to SafetyWing Insurance because we felt like we were paying too much and not ever really using the insurance.

However, it’s still true that like all insurance companies, SafetyWing isn’t perfect. For instance, because their policies are mainly designed for budget-conscious digital nomads, it doesn’t provide sufficient coverage over some areas that may be more of a priority for shorter-term travelers.

Here’s a quick overview to help you decide whether SafetyWing is the right fit for you:

| Who It’s Good For | Who Should Avoid |

| Long-term and budget-conscious travelers | Travelers with a lot of expensive gear and electronics |

| Digital nomads looking for long-term medical and trip coverage | Any person looking for comprehensive trip cancellation or trip delays coverage |

| Backpackers and people that travel without a lot of electronic devices | Travelers that love doing extreme activities and sports |

| Travelers mainly looking to cover big expenses | |

| Individuals that don’t intend on doing too many extreme sports/activities while traveling |

Is SafetyWing the Best Insurance For Working Abroad?

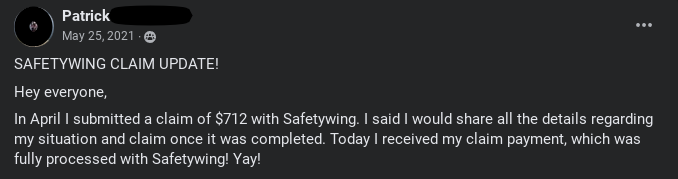

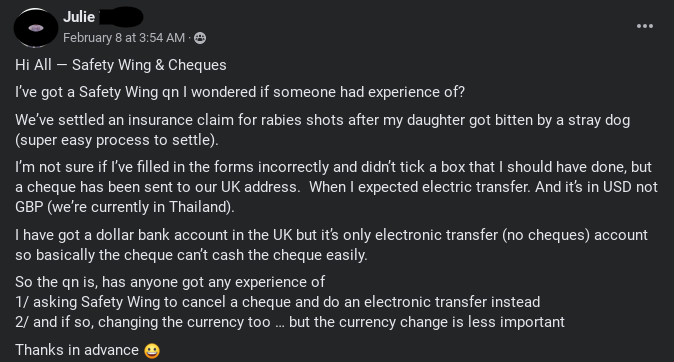

The best way to answer this is to go straight to the source…digital nomads. We belong to more than a few digital nomad Facebook groups, and there are numerous people on them sharing their experiences.

So let’s see what just a few of them have to say about whether SafetyWing is the best insurance for working abroad.

More Online SafetyWing Insurance Reviews Claiming it’s the Best Insurance for Working Abroad

Like the digital nomads in our groups, we’re very happy with our choice to move to SafetyWing Insurance. And we’re not the only ones. Check out these 5-star reviews from other happy travelers who think it’s the best insurance for working abroad.

It looks like the vast majority of the people who have tried SafetyWing consider it the best insurance for working abroad.

The Takeaway: Is SafetyWing The Best Insurance For Working Abroad?

So, does SafetyWing offer the best insurance for working abroad?

In our opinion, yes. Its policies offer great value for money and provide comprehensive coverage for medical emergencies and trip delays/interruptions — two areas that are of utmost importance when you’re working abroad.

It also has no limits on the duration of travel, which is perfect for long-term nomads. And it comes with a few other added benefits like COVID coverage, coverage for when you return to your home country for incidental reasons, and the option to include up to 2 children under the age of 10 for free in your insurance plan.

Of course, it’s not going to be the right choice for everyone — but if you’re looking for a reliable and affordable insurance company that will cover you for most of your needs while working abroad, SafetyWing Insurance is a great option to consider.

We hope you found this SafetyWing Insurance review helpful and that it helps you make a more informed decision about which insurance you should get for your next trip abroad. Should have any questions that we didn’t answer, feel free to contact SafetyWing Insurance directly, below.

If you have any questions or would like to share your own experience with SafetyWing Insurance, please feel free to leave a comment below!

Paul is a full-time SEO content writer and owner of Word Brokers, LLC. He is also a full-time digital nomad who can be found writing content with his toes in the sand on a beach in Mexico, sipping an espresso in a cafe in Colombia, or chilling by the lake in Guatemala.

4 Replies to “Best Insurance For Working Abroad – SafetyWing Insurance Review”